Scottish Government Budget - 13th Jan 2025

The Finance Secretary, Shona Robison, has published the Scottish Budget for the next financial year (2026/27). You can read its accompanying press release here.

A number of announcements are of relevance to our sector. In summary:

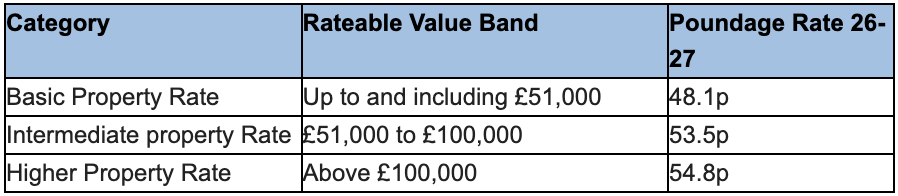

NON-DOMESTIC RATES

Non-Domestic Rates, 2026-27

Property will be revalued from 1 April 2026, based on rental values as of 1 April 2025. Revaluations are now on a three-year cycle. A Revaluation Transitional Relief to protect those most affected by revaluation and will cap increases in gross bills up to the next revaluation in 2029. Increases in NDR gross liabilities due to revaluation will be capped at 15 per cent(cash terms) in 2026-27 for small properties, rising in subsequent years.

Small Business Bonus Scheme relief will be maintained at the existing rates and thresholds for the next three years of the revaluation cycle.

Retail businesses with a rateable value of up to £100,000 will receive 15% rates relief, available for three years. This will be capped at £110,000. Island stores and in three prescribed remote areas (Cape Wrath, Knoydart and Scoraig) get 100% relief instead.

Under new Small Business Transitional Relief, eligible ratepayers will pay 25 per cent of any increase to their net bill in the first year (2026-27), 50 per cent in the second year (2027-28) and 75 percent in the third year (2028-29).

CRIME AND POLICING

Increase of £59 million resource budget for policing.

Investment of £3 million to continue the work of Police Scotland’s Retail Crime Taskforce to support efforts to prevent shop‑based theft and pursue those responsible.

Additional £10 million investment in community justice services to support shift to the use of more community‑based sentences.

Funding for 2026-27 will support the Crown Office and Prosecutor Fiscal Service in continuing to address the criminal case backlog, continue to investigate Covid-19 deaths, and manage demand-led pressures. Targeted and time limited funding will support efforts to comply with legislative timescales and reduce waiting times for justice.

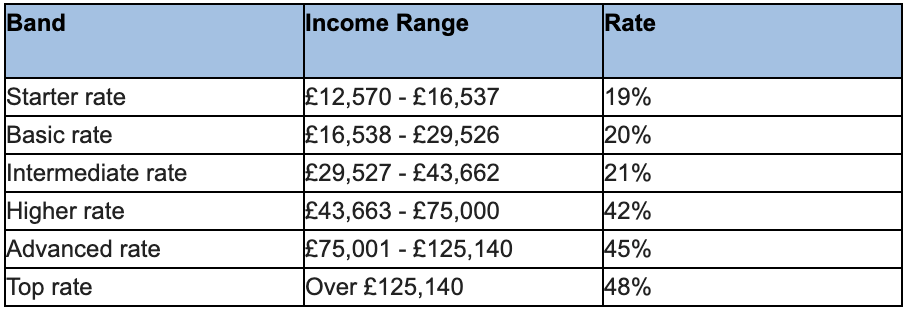

INCOME TAX

In 2026–27, the basic and intermediate rate thresholds will increase by 7.4 per cent.

The higher, advanced and top rate thresholds will be maintained at their current levels. In line with the UK Government’s decision to extend the freeze on personal tax thresholds, these thresholds will remain unchanged until 2028–29.

Scottish Income Tax Policy Proposals 2026-27

OTHER ANNOUNCEMENTS

£31.7 to progress Scotland’s transition to a circular economy. Scottish Government plan to deliver actions from Scotland’s Circular Economy and Waste Route Map to 2030 to further waste reduction, encourage reuse, repair and recycling, and reduce emissions associated with waste and resource management.

Throughout 2026, The Crown Office will embed processes from the national implementation of digital Witness Gateway and Defence Agent Service and work with partners to promote use of the Digital Evidence Sharing Capability across all courts in Scotland to enhance and innovate delivery of public services.

On the Scottish Investment Bank, the Budget commits to the commitment to invest £1 billion in the Bank by the end of this parliament. It keeps it on track to invest £2bn over the first 10 years.